Cash Flow Model

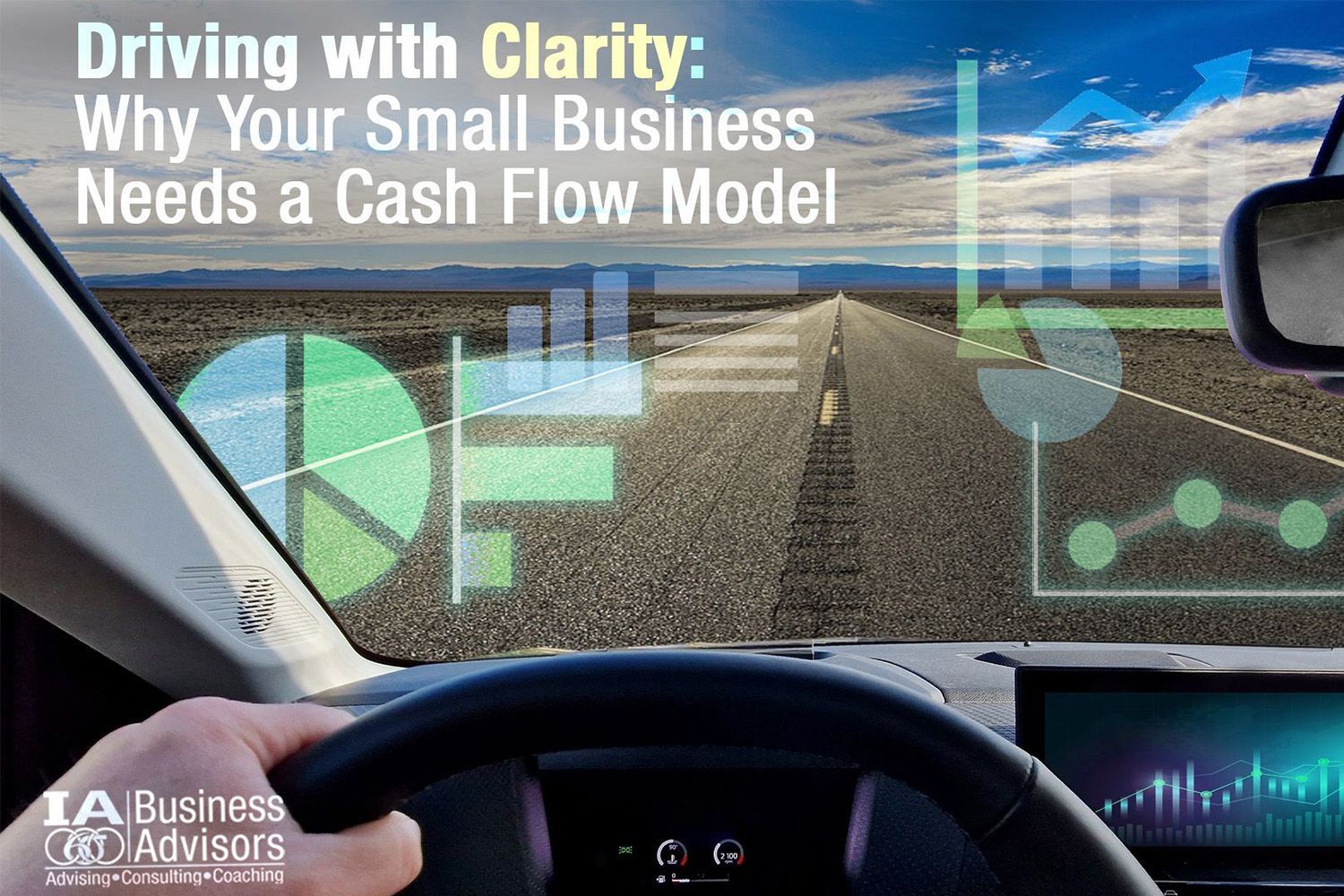

Driving with Clarity: Why Your Small Business Needs a Cash Flow Model

Running a small business is much like driving a car—you need clarity to stay on course. At IA Business Advisors, we believe clarity comes from making decisions grounded in S.M.A.R.T. principles: those that are Specific, Measurable, Attainable, Realistic, and Timely. Yet, too many small business owners rely solely on their income statements. While valuable, these statements function like the rearview mirror: they reflect where you’ve been, not where you’re headed.

If your goal is to grow or address cash flow challenges, focusing only on past performance can leave you unprepared for what’s ahead. That’s where a Cash Flow Model—your windshield view—provides clarity and empowers you to lead your business with confidence.

The Income Statement: The Rearview Mirror

Your income statement summarizes past performance by detailing revenue earned, expenses incurred, and profit achieved. While essential for understanding historical trends, it doesn’t offer actionable insights into the future.

For instance, your income statement might show profitability, but if cash is tied up in accounts receivable or inventory, you might struggle to cover immediate expenses like payroll. This disconnect underscores the importance of forward-thinking tools that align with S.M.A.R.T. Management principles.

To make Specific and Measurable decisions, you must look beyond historical data and focus on actionable insights that guide your future.

The Cash Flow Model: The Windshield

A cash flow model embodies S.M.A.R.T. Management by enabling Attainable, Realistic, and Timely planning. This dynamic tool projects your cash inflows and outflows, helping you anticipate challenges and seize opportunities with clarity.

Here’s why a cash flow model is transformative:

- Visibility into Spending: Understand where and when your money flows.

- Cash Shortfall Warnings: Identify potential gaps early and take proactive steps.

- Informed Decision-Making: Confidently plan for hires, investments, or expansions.

- Support for Growth: Manage financial demands while scaling effectively.

For example, imagine you’re planning a new hire. A cash flow model might reveal that delaying the hire by one month avoids a potential cash crunch, aligning the decision with both Realistic goals and Timely constraints.

Why Both Tools Matter

Your income statement and cash flow model form a collaborative team, much like the alignment of resources emphasized in S.M.A.R.T. Management. The income statement tells you where you’ve been, while the cash flow model shows where you’re going. Together, these tools provide the clarity needed to navigate confidently toward your business goals.

Take Action: Build Your Cash Flow Model Today

Operating with only a rearview mirror is risky, especially during periods of growth or cash flow uncertainty. Building a cash flow model aligns with S.M.A.R.T. Management principles, enabling you to make Specific, Measurable, Attainable, Realistic, and Timely decisions that drive success.

Here’s how to get started:

- Outline Your Cash Flows: Break income and expenses into weekly or monthly projections.

- Monitor and Adjust: Update regularly to reflect real-time changes.

- Seek Expert Help: Engage a financial advisor or use cash flow management software to ensure your model is robust.

By combining actionable insights with strategic foresight, you’ll lead your business with clarity, confidence, and S.M.A.R.T. Management.

Ready to Drive with Confidence?

At IA Business Advisors, we specialize in helping business leaders navigate challenges with clarity and purpose. Through our S.M.A.R.T. Management philosophy, we empower you to make informed decisions, avoid cash flow pitfalls, and thrive in an ever-changing environment.

Visit our blog for more insights or contact us today for personalized guidance. Let us help you build a cash flow model that drives your business forward.