Was the SBA-PPP just a data collection project?

SBA PPP business consulting

Written by: Brian Smith & Mary Smith

My job as a business consultant is helping small businesses. Our clients range in size from three to over a thousand employees. Our firm is experiencing a high volume of new and current clients looking for advice on how to navigate the chaos of Covid-19. The U.S. government’s response to this crisis has been as one would expect, but not as one would like.

There has been a lot of Monday morning quarterbacking from the media, saying the administration is either doing great or they aren’t doing enough. This rhetoric is based on opinions of subjects that most of us have very little background knowledge on or experience in. Listening to all the talking heads can be overwhelming at times, but now I find myself jumping headlong into the fray.

On March 27, President Trump signed the CARES Act which included $349 billion in small business loans through the Small Business Administration. Our firm supported our qualifying clients looking to capitalize on the SBA Paycheck Protection Program. This program is available to small businesses with less than 500 employees to offset payroll and other expenses. The program is being managed through the U.S. banking system, specifically through SBA-approved lenders.

Early on, I predicted that roughly one in five hundred small businesses would receive this funding. Despite these feelings, I promoted the program and urged our clients who needed funding to apply, knowing that it would create a larger pool to compete against. My firm’s application, at this time, has yet to be submitted due to banks shutting down the application process due to the overwhelming number of applicants.

Late last week, we got our first glimpse at how successful the program has been in just the two short weeks since it was signed. Fox News reported that as of Thursday April 9, 2020, 465,000 small businesses received funding and the committed funds totaled $120 billion. However, the way the numbers were reported was typical for news outlets. They lacked context by providing high-level percentages identifying the number of businesses that have applied (70 percent) and those that may apply in the future.

While these numbers may seem falsely exciting to some, they bear the truth of the SBA-PPP: Getting money from it will be like winning the lottery. There are between 27 and 30 million small businesses in the United States, depending on which data resource you look at. Even if we assume that the lowest number is correct, if 70 percent of 27 million applied, that means that over 18 million companies have already applied and there are still between eight and nine million that may apply.

If 18 million small businesses have applied, and only 465,000 have been approved, that is about a 2.5 percent approval rate. The problem is that those 2.5 percent who are approved have already used over 34 percent of the available funds. At this rate, less than 1.3 million of the 27 to 30 million small businesses will receive funding, leaving more than 25 million business owners and nearly sixty million Americans wondering, “Now what?”

First, we will survive this crisis as Americans always do. We will come together in support of our own areas of influence. The proof is on your local news channels; people are supporting their communities, local small businesses, and the people that work for them. If there is one positive thing a crisis can do, it’s bring people together. This is what our current events, as well as history, show us.

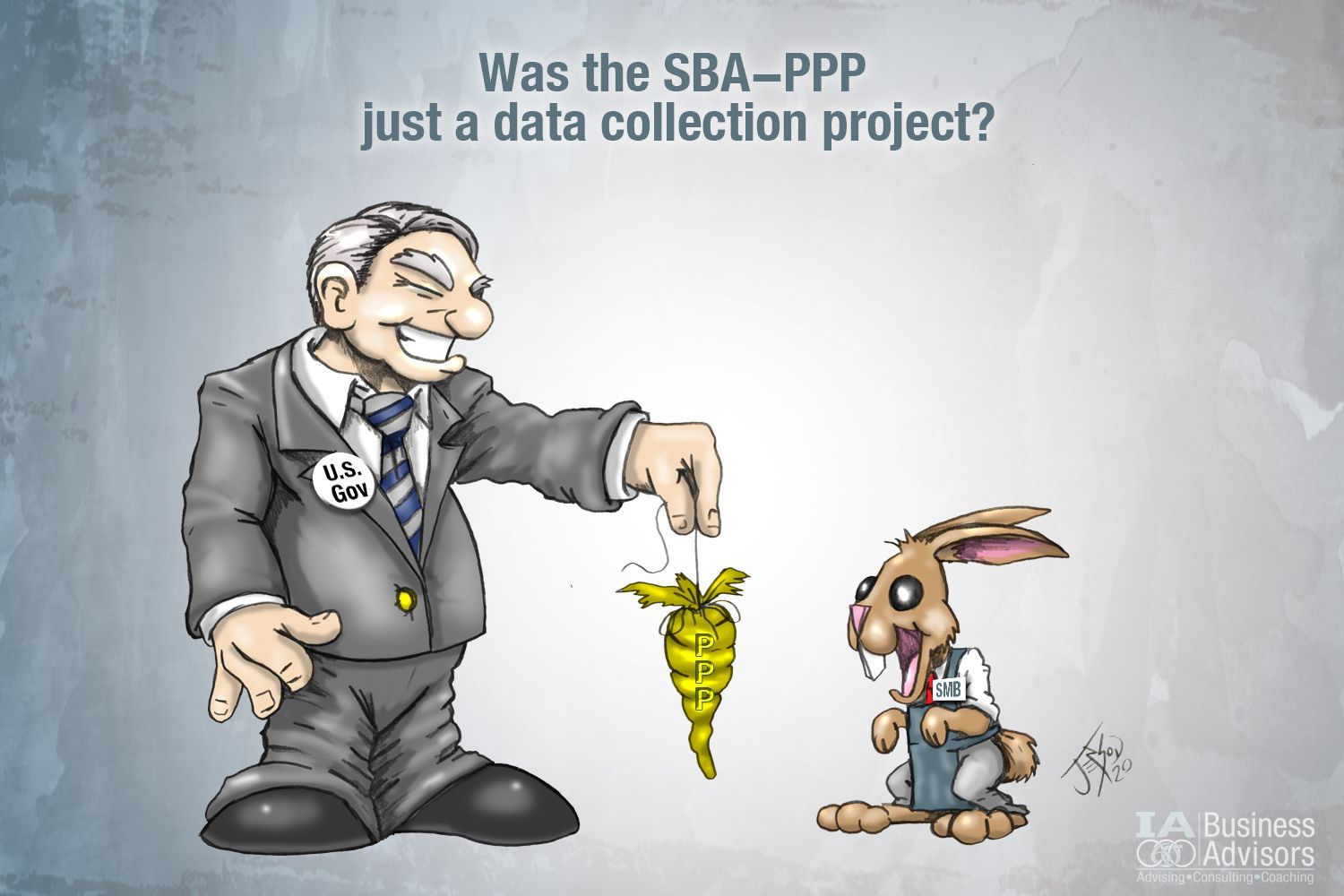

However, I can’t help but wonder. Did the government knowingly dangle a golden carrot of $349 billion in front of small businesses in America as a way to collect massive amounts of data on the one fragmented part of society it has the least control and insight over? Government and the people who work in government really don’t understand small business. They have no idea what it takes to make a small business work, not the technical, psychological, or emotional aspects.

By putting the SBA-PPP out through local banks, the U.S. government created a vehicle for it to collect massive amounts of data from the majority of the largest sub-section of business in the country. Seventy percent of small businesses willingly submitted massive amounts of financial, technical, and personal data to the banks for the U.S. government in hopes they would be awarded free money. The U.S. government is then paying the banks 1 to 5 percent of each loan provided, as a fee for collecting and disbursing the funds.

Did Americans just have our data pockets picked in the fastest and most comprehensive data collection program ever carried out by our country? One must wonder. Regardless of the catalyst of the SBA-PPP, one thing is certain. Small businesses across the U.S. will need to figure out their own viability. The government is not going to have an answer for more than 95 percent of small businesses but will be more than ready to begin taking our tax money and enforcing its own collection actions against us in the near future.

From one small business owner to another, remember this: You built your company along with your team, and together you will rebuild it. Regardless of what is motivating our government officials, we as the backbone of the U.S. economy can and will work together to carry us out of this crisis and overcome whatever challenges Covid-19 and our government put in front of us.

© Individual Advantages, LLC 2020 April 13

The post Was the SBA-PPP just a data collection project? appeared first on IA Business Advisors.